How to Cash a Check: Your Best Options

A check is only as valuable as your ability to cash it. Whether it's a paycheck, personal, or government-issued check, knowing where to cash it is key. Not everyone has a bank account, and even with one, you may need quicker or more convenient options. Banks, retail stores, check-cashing services, and mobile apps all offer ways to access your funds, but each comes with its own set of fees and limitations.

The best option for you depends on factors like fees, speed, and convenience. This guide helps you navigate your check-cashing choices, ensuring you make the right decision based on your needs and preferences.

Top Check-Cashing Locations

If you're looking for top check-cashing locations, here are some popular and reliable options across various categories, providing convenience and flexibility for cashing your checks.

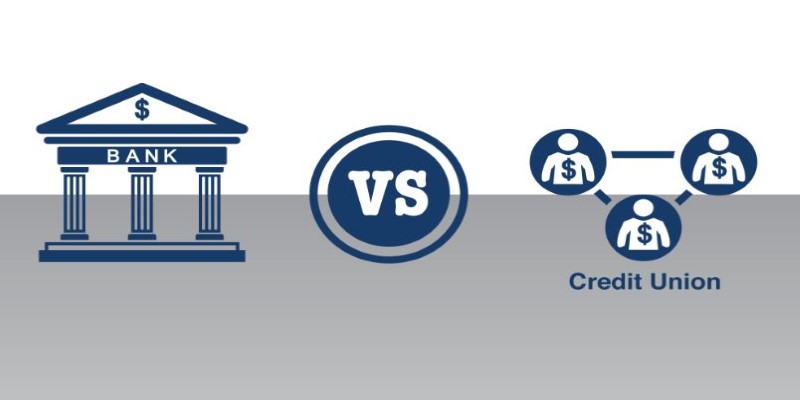

Banks and Credit Unions: The Traditional Choice

Banks and credit unions are among the most secure places to cash a check. If you have an account at the issuing bank, cashing a check is usually free. Non-customers can also cash checks at some institutions, though a small fee may apply. Having an account allows you to deposit the check and withdraw cash later, bypassing fees.

Yet banks tend to put holds on big checks, making quick access to funds impossible. Limited banking hours are also inconvenient for those with unstandardized schedules. Others can get their checks cashed at some banks, particularly payroll or government checks, but at a greater cost. Saving money in the long term comes with opening an account.

Retail Stores and Grocery Chains: Convenience with a Cost

Many large retail stores, such as Walmart and Kroger, offer check-cashing services for a fee. These services are convenient, with extended hours and widespread availability. Retail check cashing is generally more affordable than using check-cashing stores, though still pricier than banks. Walmart charges a small flat fee, which is typically lower than what independent check-cashing businesses charge.

However, these stores don't cash personal checks, and the check amounts are limited. Some grocery stores also offer check-cashing services but may require a membership or rewards program. Additionally, some stores let you load the check amount onto a prepaid debit card, providing a cash-free spending option.

Check-Cashing Stores: Quick but Expensive

Check-cashing businesses specialize in turning checks into cash instantly. These locations are ideal for those who don't have a bank account or need immediate funds. However, they come with high fees—often a percentage of the check's total amount. This means larger checks can cost a significant amount of cash. The biggest advantage of check-cashing stores is speed. There’s no waiting for funds to clear, no need for a bank account, and no risk of holds on your money.

These businesses also cash a wider variety of checks than banks, including personal checks, which banks and retail stores often refuse. Despite the convenience, these services should be a last resort if you have other options. Over time, frequent use can lead to high costs that add up, making it more expensive than simply opening a bank account.

Mobile Banking Apps and Online Services: The Digital Approach

Mobile banking apps have made cashing checks online an increasingly popular option. Many major banks allow users to deposit checks by simply taking a photo, though funds might not be available right away due to processing times. There are also dedicated mobile apps like PayPal, Venmo, and Ingo Money that offer check-cashing services. These apps may deposit funds instantly but typically charge a fee for immediate access.

If you don't need fast cash, deposits are usually free, though they can take a few business days. Online check cashing is ideal for those who don't need immediate access to funds and prefer a secure, cash-free option. It requires a smartphone and an app account.

Employer and Payroll Services: Direct Deposit Alternatives

If you receive checks regularly, signing up for direct deposit through your employer can eliminate the need for check cashing. Payroll services allow wages to be directly deposited into a bank account or prepaid card, helping you avoid check-cashing fees. Some employers offer on-site check cashing, where you can cash your paycheck directly at work, usually at a lower cost or for free compared to retail or check-cashing services.

Though less common, it's worth checking if your employer offers this. Prepaid payroll cards are an alternative for those without a bank account. These cards work like debit cards, allowing you to receive and spend money without carrying cash, though some cards may charge fees for ATM withdrawals or balance inquiries.

Prepaid Debit Cards: A Non-Banking Solution

Prepaid debit cards offer another option for check cashing. Many financial institutions and retail stores allow you to load a check onto a prepaid card, which you can then use for purchases or ATM withdrawals.

While convenient, prepaid cards often come with various fees, including activation fees, monthly charges, and ATM withdrawal costs. Still, for those without a bank account, they can be a useful tool for managing money without relying on cash.

Post Offices: Limited but Available

Some post offices offer check-cashing services, though options are usually limited to U.S. Treasury checks. This means you can cash tax refunds or government-issued checks but not personal or payroll checks. The fees at post offices are generally lower than those at check-cashing stores, making them a reasonable option if you qualify.

While post office check cashing isn’t widely available, it’s worth considering for government payments. The only drawback is that post offices operate during business hours, making access more restricted than other options.

Conclusion

Cashing a check is easier when you know your options. Banks and credit unions offer security and low fees, especially if you have an account. Retail stores provide convenience but come with higher fees and limitations. Check-cashing businesses offer instant access to funds, though they can be costly. Exploring mobile apps and digital options can also be helpful for quick cashing. Ultimately, choosing the best option depends on your needs, fees, and how quickly you need access to your funds.